Why choose us

Credit Card

Visa and Mastercard® cashback cards, mobile payment, Multiple currencies, low rate, travel, rewards Miles & More and much more.

Home Loan

Get the right mortgage to finance your new home. Buy and affordable home ownership schemes to help first-time buyers and home movers

Gain First Simple Endowment Life Insurance

Build financial stability with guaranteed cash returns every year combining insurance coverage with savings.

Business Loans

Business loans for short-term investments, pre-financing, and to increase flexibility. The business loan is for SMEs, self-employed, or liberal professions

Investment Services

Cash management, trade, securities, and fund services to multinationals, financial institutions, government, and public-sector organizations

Apply for Payroll service for legal entities

Payroll Management, Contractor Payments, and Employer of Record service, all in one place

Financial wellbeing

Plan, track and achieve your goals

Take charge of your financial journey with tools and guidance designed to help you build a stronger future.

- Easily view your cash flow and track bills

- Grow your money faster with automated savings tools

- Send and transfer money quickly and safely any time

Smart Notification

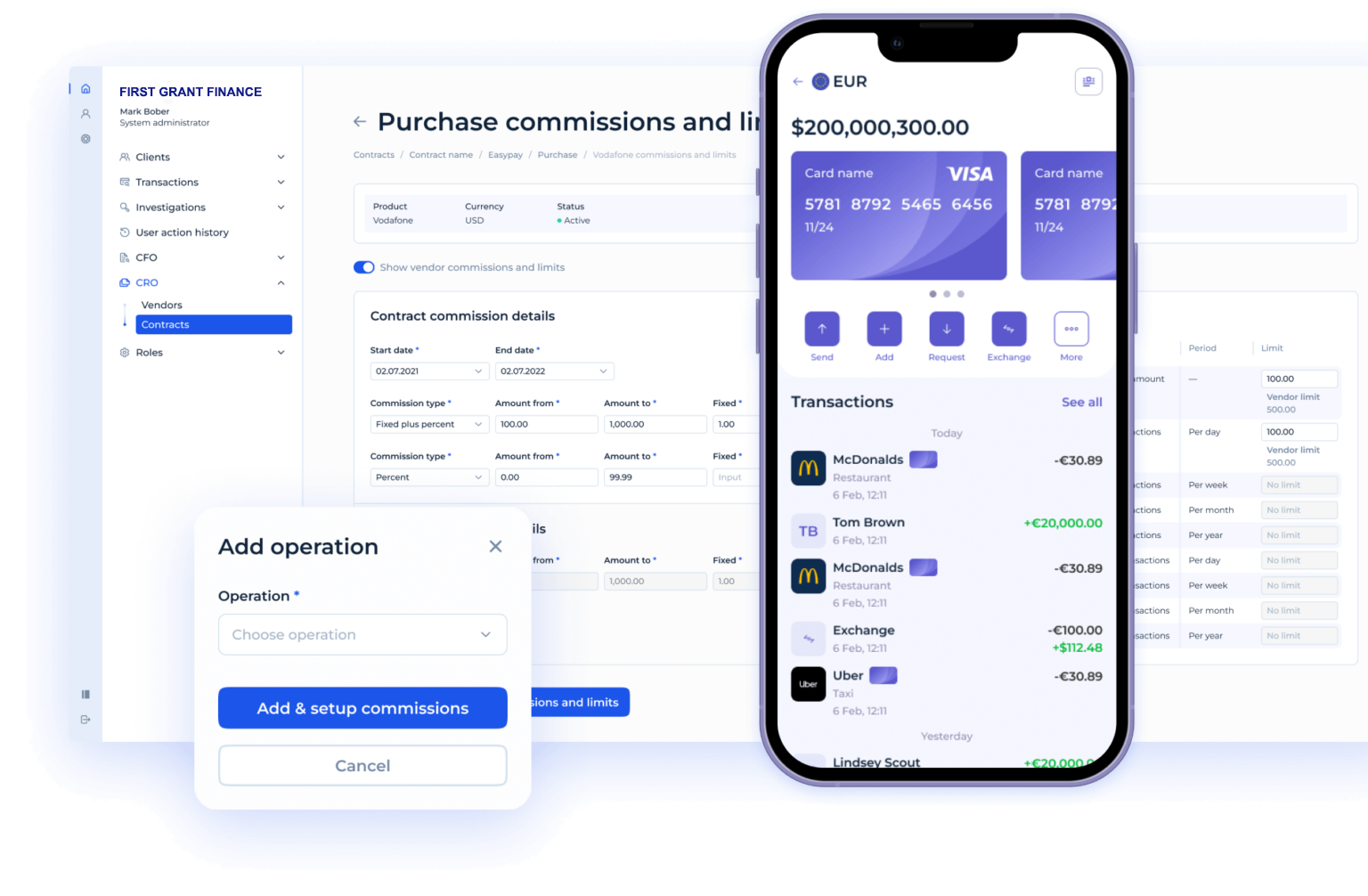

Business Banking for Your Company

First Grant Finance is proud to serve business owners in our communities with customized, cutting-edge financial solutions. We understand that every business has its own unique challenges and goals, which is why we don’t believe in one-size-fits-all banking. From startups to established businesses, we help our clients grow with confidence, supported by our responsive team and powerful tools. If you’re ready to explore how business banking can drive your company’s success, we invite you to contact us today.

- Keep personal and business financess separate

- Gain access to flexible financial solutions

- Streamline operations with cash management tools

personalized finance

Today’s Banking and Finance Clients

This approach recognizes that every customer is unique and requires personalized attention to achieve their financial goals effectively. It provides flexible financing, streamlines operations, offers robust security, and provides support from local experts.

- Money Management

- Building Credit

- Accessibility